child tax credit 2021 dates canada

The following amounts are for the payment period from July 2022 to June 2023 and are based on your AFNI from 2021. However children born after January 2021 wont be eligible for the.

The 2021 Child Tax Credit Implications For Health Health Affairs

Here is some important information to understand about this years Child Tax Credit.

. Wait 10 working days from the payment date to contact us. If you do not receive your GSTHST credit. Its the child tax credit which will deliver 3000 per child 3600 for children 5 and under to the vast majority of families over the next year.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Canada child benefit payment dates. If you have a child under the age of 18 with a social security number you qualify for the child tax credit.

Tax credit for people making a home accessible eligible homes and eligible expenses Childrens special allowances Monthly payment for eligible federal and provincial agencies and institutions. Visit ChildTaxCreditgov for details. The child tax benefit pay dates are the same all across Canada whether you are in BC Alberta or whether you are in Ontario.

In 2022 the tax credit could be refundable up to 1500 a rise from. 15 opt out by Aug. From June 2021 to June 2022 each child.

May 28 2021 includes January and April payments July 30. The CRA makes Canada child benefit CCB payments on the following dates. There is a 135 phase-out rate for income between 32797 and 71060.

For 2022 the monthly family allowance dates are listed below. The CCB may include the child disability benefit and any related. The province doesnt matter.

The Canada Child Benefit CCB previously known as the Canada Child Tax Benefit CCTB is a program offering monthly payments to eligible families to help with the. Families with children under the age of six can receive up to 1200 per child in four payments for the year 2021. If you have a child that is eligible for the disability tax credit there is a chance they may also be eligible for the child disability benefit.

If your AFNI is under 32797 you get. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. 6997 per year 58308 per month for each eligible child under the age of 6.

Maximum Canada child benefit. The Child Tax Credit provides money to support American families. Estate Planning Tax Recovery In 2021 Tax Refund Tax Services Income Tax Is the Child Tax Credit for 2020 or 2021.

Most of you will typically receive your yearly GST credit in four installments each on the fifth of July and October then the following year in January and April unless the fifth is a. The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the additional one-time goods and services tax. CCB Payment Dates for 2022.

13 opt out by Aug. If a family is entitled to receive the CCB. 5903 per year 49191 per month for each.

It is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. Irs Child Tax Credit Payments Start July 15. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

The maximum annual CCB for two children under 6 years is 13994 ie. Where the 20th of any given month falls on a weekend the payment is deposited. We calculate the CCB as follows.

150000 if you are. 150 per child if the net family income for 2019 is more than 120000. The Canada Revenue Agency usually send the GSTHST credit payments on the fifth day of July October January and April.

300 per child if the net family income for 2019 is 120000 or less. Canada workers benefit CWB - advance payments All payment dates.

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Enhanced Child Tax Credit For 2021 Azzad Asset Management Halal Investment

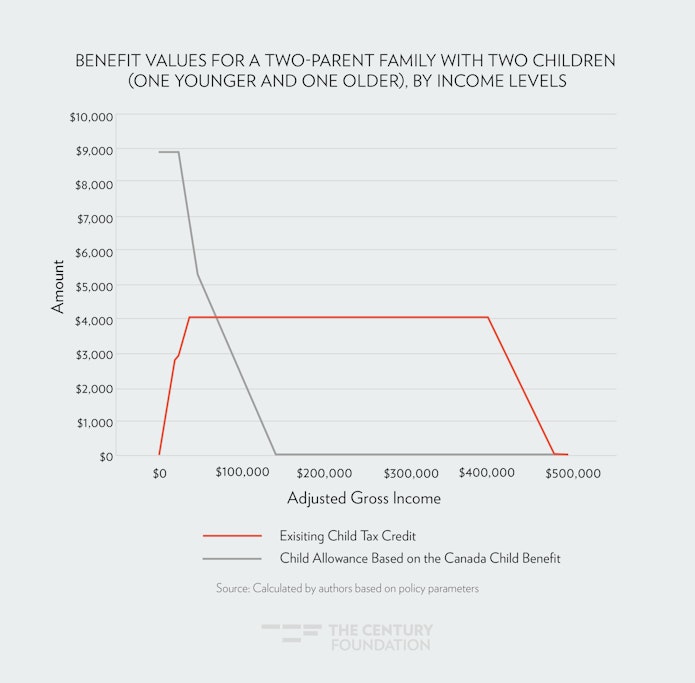

What A Child Allowance Like Canada S Would Do For Child Poverty In America

Child Tax Benefit Payment Dates For 2022

Fill Free Fillable Government Of Canada Pdf Forms

What Is The Child Tax Credit Tax Policy Center

Congressman Tim Ryan Holds News Conference Explaining New Child Tax Credit Wytv

Child Tax Credit Resources And Faqs Children S Defense Fund

Canada Child Benefit Ccb Payment Dates Application 2022

What Is The Earned Income Tax Credit Tax Policy Center

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

The Disability Tax Credit Guide Updated February 2022

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit 2021 Dawson County Schools

A Ticking Clock And The Faces Of The American Child Tax Credit Humanity Forward

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

What Are Marriage Penalties And Bonuses Tax Policy Center

Loans That Accept Child Tax Credit Lionsgate Financial Group